Amazing Tips About How To Buy California Bonds

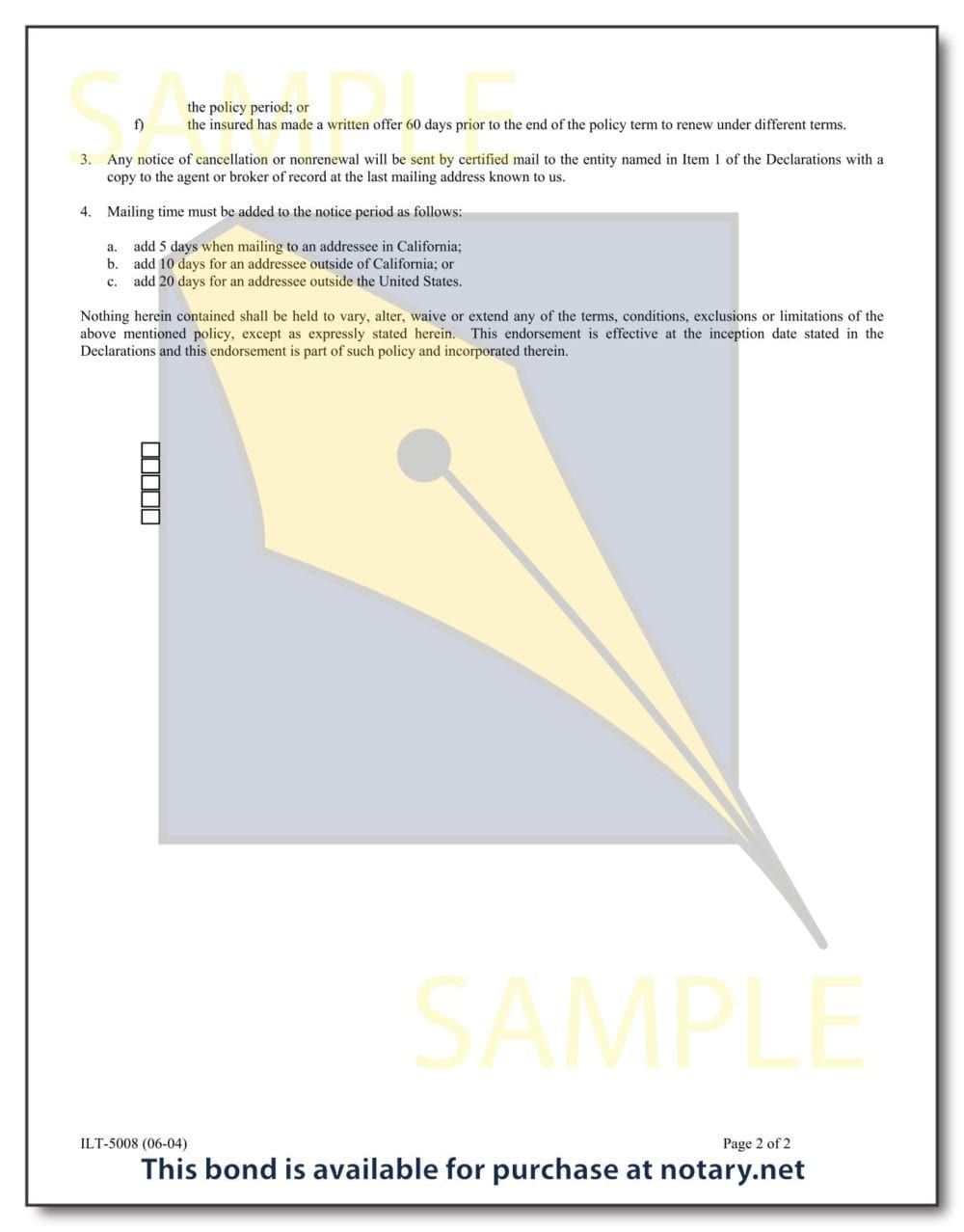

The nature and extent of the guarantee, however, are subject to the language used when the bond is.

How to buy california bonds. See details in overpay your taxes to buy i bonds. If you were quoted a price of $98, and you bought 10 bonds, the total cost would be $98,000 ($98 price of bond x $100 = $9,800 value per bond x 10 bonds = $98,000). Be an efficient way to.

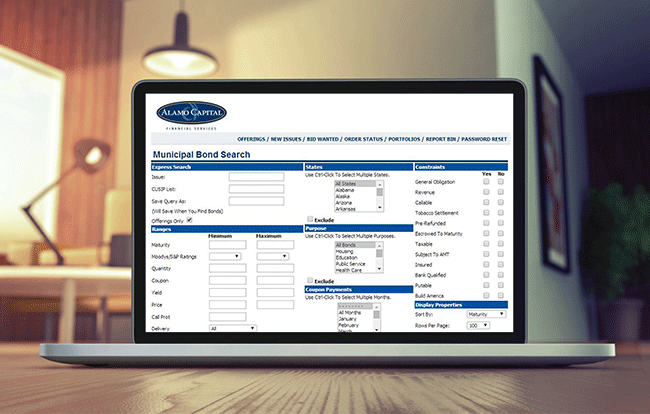

Track cusips, learn about issuers and dive deep into every california municipal bond. With a simple bond ladder, you would purchase three $5,000 bonds with staggered maturity dates: In order to encourage california residents to invest in their home state, buy california bonds is offering a retail order period (rop) where individual investors can submit.

California bonds are contracts designed to do one thing: Remember, california has the 7th largest economy in the world, don't let some misleading news make you miss out. The better the credit rating, the cheaper the borrowing cost.

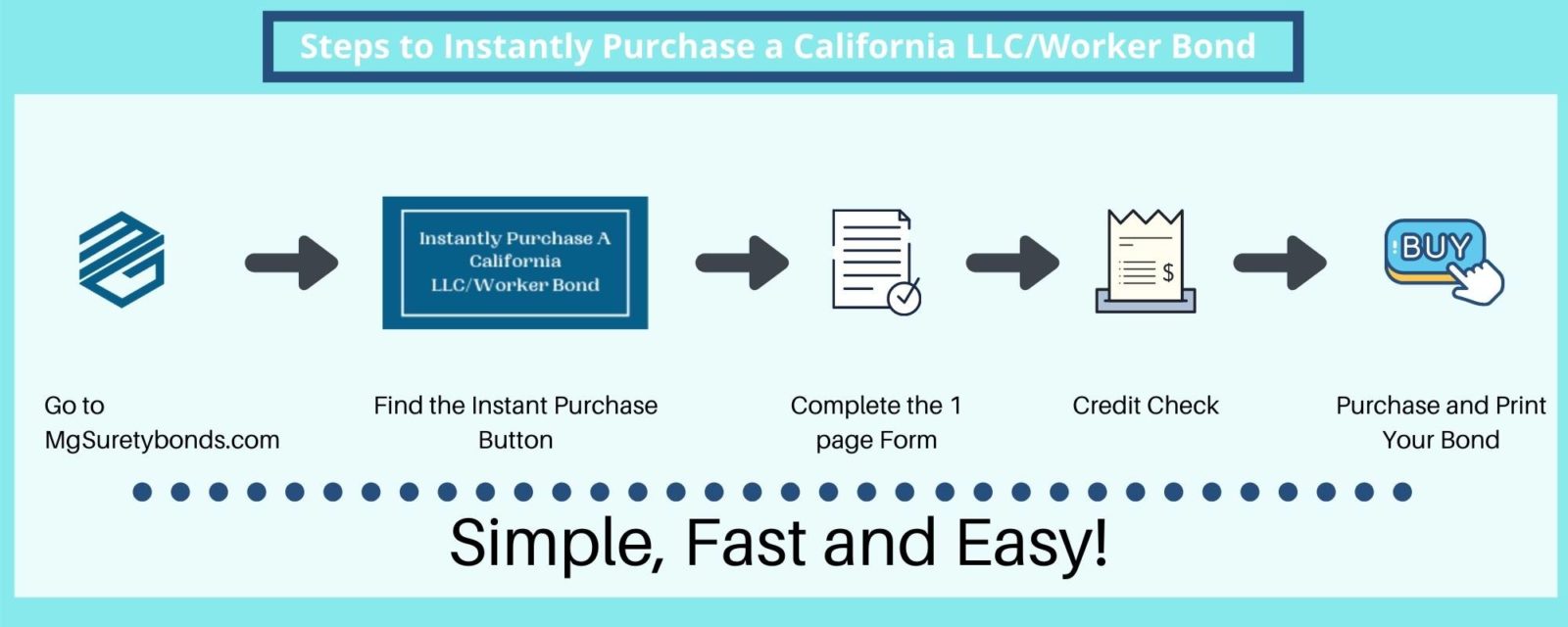

One year, two years and three years, for instance. Consulting a surety professional is the best way to determine your exact surety bond cost in california. If you’re interested in financing projects and activities in california, you can buy california bonds.

Follow the prompts to specify the security you want, the purchase amount, and other requested information. Buy paper bonds with money from your tax refund when you file your tax return with the irs each year. Login to your account and click the buydirect® tab.

Our experienced team of california bond. California infrastructure and economic development bank clean water state revolving fund, series 2022 offering summary. As each bond comes to.

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)